That’s why we offer a downloadable candlestick patterns cheat sheet PDF. This PDF is perfect for day trading beginners who want to better understand chart patterns. It’s also great for more experienced day traders who want a quick reference guide to use while scanning the markets. This cheat sheet PDF is an invaluable asset for anyone looking to become a successful day trader.

The hanging man candle, is a candlestick formation that reveals a sharp increase in selling pressure at the height of an uptrend. It is characterized by a long lower wick, a short upper wick, a small body and a close below the open. Learn to take profitable trades with my price action trading course. Start with Steve Nison’s Japanese Candlestick Charting Techniques, which is the closest you can get to the source of candlestick patterns without picking up a Far Eastern language with three scripts. As this candlestick chart shows; the candle wicks will often move out of the breakout area, but the candles do not close outside.

FREE Options Trading Coaching

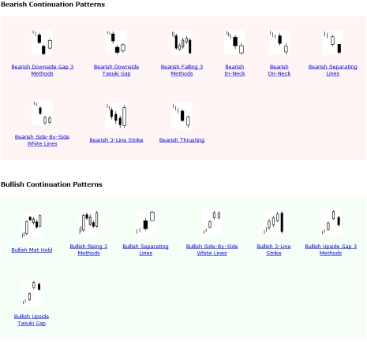

Now that you’re aware of the most popular forex candlestick patterns, unfortunately you can’t just blindly enter trades whenever you see them form. A three inside up is another candlestick pattern that signals a bullish reversal, when formed at the end of a bearish trend. Forex Japanese candlestick patterns are specific candlestick patterns that can signal a continuation of the underlying trend, or a trend reversal. These patterns can be single candlestick patterns, which means that they’re formed by a single candlestick, or multiple candlestick patterns which are formed by two or more candlesticks. The pairings below will get you started on studying the similarities and differences between bar patterns and candlestick patterns. The Hanging Man pattern is a seemingly bullish candlestick at the top of an upwards trend.

The Marubozu is more useful as a learning tool than as a pattern for trading. Together with the Doji candlestick, they highlight the extremes of the candlestick spectrum. As much as I tried to keep this study as objective as possible, there is some inherent subjectiveness in technical analysis. For example, while most candlestick patterns to master forex trading price action people can universally agree on the dimensions of a Bearish Engulfing and how they appear, the background in which they form is more fluid. In this sample, I considered if the BE closed under the pre-candle open and not the pre-candle low. Furthermore, this is based on a sample of a little over 200 Bearish Engulfings.

How to trade on candlestick charts with FOREX.com

Still, you need to be careful if the difference is so significant that it can eventually affect your trading outcomes. Sometimes, we notice that there is more than one bar grouped together, which then could make it easier for you to collect clues and see the story from a bigger perspective. In other words, the more group of candlesticks formed together, the more complete the story will be. If you have the chart on a daily setting each candle represents one day, with the open price being the first price traded for the day and the close price being the last price traded for the day. Get started with candlestick trading with the strategies below.

Find your Forex entry point: three entry strategies to try – ig.com

Find your Forex entry point: three entry strategies to try.

Posted: Thu, 29 Sep 2022 03:59:59 GMT [source]

The market fell over the period, meaning the top of the body is the open, and the bottom is the close. It consists of three bearish candles in a row, each larger than the previous and featuring little to no lower wick. For this pattern to be valid, each bullish candle must be larger than the previous and have minimal upper wick. A morning star shows a change-over of control from the bears to the bulls.

Current Forex Rates

When used in conjunction with trends and simple support/resistance levels, forex candlestick patterns become one of the simplest and most powerful analysis tools available. What could possibly be more important to a technical forex trader than price charts? Forex charts are defaulted with candlesticks which differ greatly from the more traditional bar chart and the more exotic renko charts. These forex candlestick charts help to inform an FX trader’s perception of price movements – and therefore shape opinions of trends, determine entries, and more. Three inside up and down patterns are triple candlestick patterns, which means that they’re formed by three candlesticks. Hammer and hanging man patterns are also reversal patterns which form at the tops and bottoms of uptrends and downtrends.

- One of the most popular concepts is called price action trading.

- The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organisation, committee or other group or individual or company.

- Many traders only include the bodies of the candles, but this is a massive mistake because a lot of information is gained from the wicks.

- Appearing in uptrends, it may look like bears are taking over – but the rising three is a bullish pattern.

- The doji pattern is a specific candlestick pattern formed by a single candlestick, with its opening and closing prices at the same, or almost the same level.

This is also why marking your support and resistance levels using line charts is a massive NO, NO. When candlestick patterns are used alongside trends and support/resistance levels, they become a powerful, forward looking market analysis method. As we’ve previously stated, the best Forex trading candlestick strategy is to use candlestick patterns for trade setup confirmations. Let’s take a look at the following charts, which show how to use candlestick patterns for day trading Forex the correct way. A Bearish Engulfing (BE) is a candlestick pattern that can be identified when looking at virtually any financial trading instrument. As implied by the name, technicalists will often use these as signals that an upward-trending market might be readying to reverse.

Two Candle Patterns

Quite often traders will see price move to an area and the candle wick will test and area, but the candle body will not be able to close through. Quite often the support/resistance level has held until the candle body has closed through. New traders can often be scared away from really large candles and this is often the opposite to what they should be doing. Some traders find it easier to read bar charts; others prefer candles.

The candle body stands for the real price change of the candle regardless of its intra-candle excursions. Hence, it represents the real and conclusive movement of the candlestick. Thus, it is not surprising that many Harami candlestick patterns are also inside bars. While the average trend finished almost -0.3% after 20 days, 2/3 of them remained below the top.

Take your forex trading to the next level

Forex candles, or the candlestick chart, are OHLC charts, which means that each candle shows the open, high, low, and close price of a trading period. Forex candlestick patterns are a popular tool to analyse price charts and confirm existing trade setups. They have been used for hundreds of years by Japanese rice traders and have made their way to the West through Steve Nison’s books. In this article, we’ll cover what Forex candlestick patterns are, how they’re formed, and how to trade on them. Reading candlestick charts is not just about knowing the formations.

The gap required to make this pattern a reality, once again won’t be found very often on the more liquid forex markets such as the majors. As the forex markets feature less gaps than equities, this pattern is less prominent and worth less of your time analysing as a result. This is because the bulls have shown that they’re now in charge of the market after swamping the bears who were shown to be running out of power with that small bearish candle. They show a potential bottom may be forming at the end of a bearish trend.